Award-winning PDF software

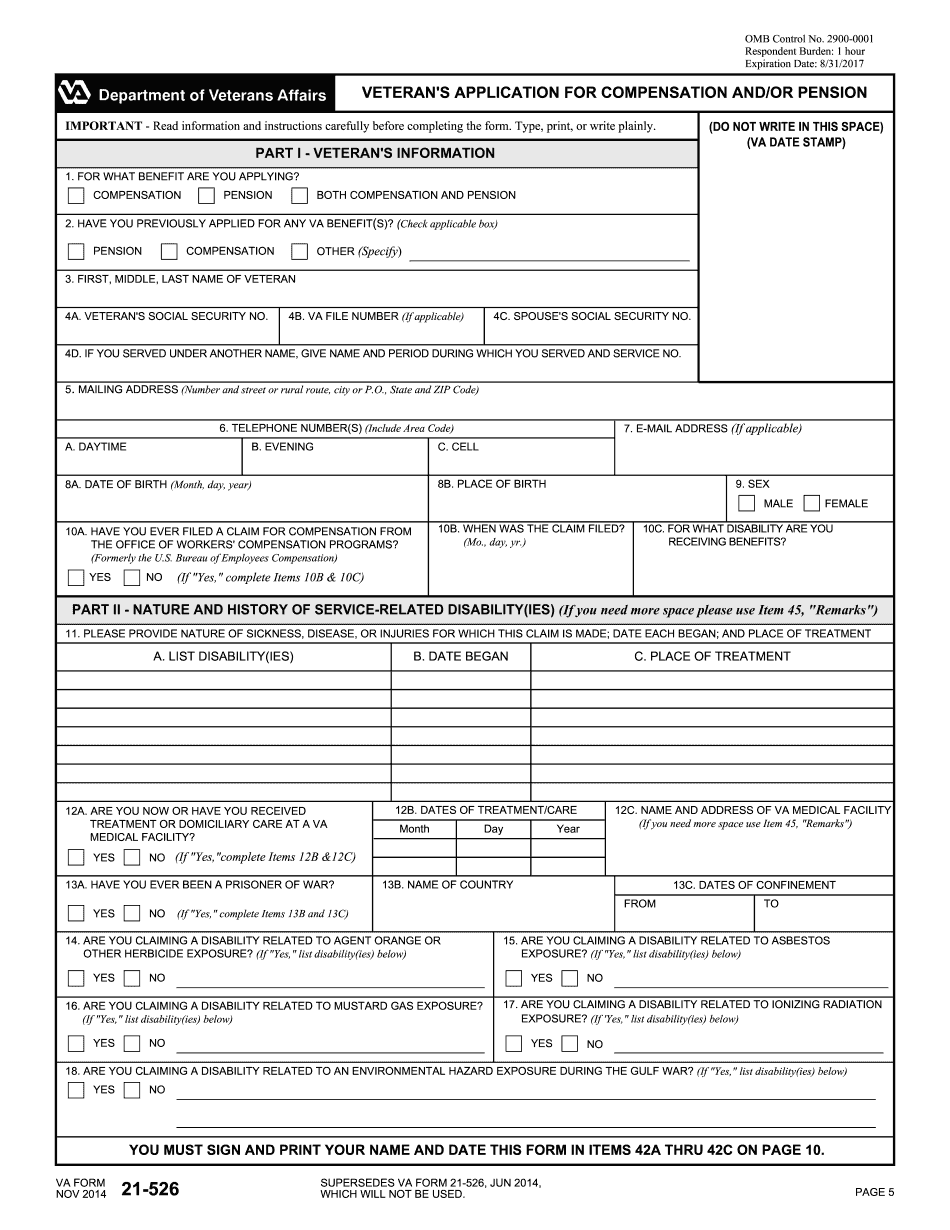

21-526Pdf - Veteranaidorg: What You Should Know

If they don't claim their deduction within 25 years of the tax year in which a distribution was made, the excess contribution will be forfeited. If a fund fails to meet the criteria and a claim of excess contribution is filed, the organization will lose access to future benefits, including the qualified education and qualified retirement benefits offered or funded. — U.S. Department of the Treasury Notice of Proposed Rule making: For-Profit Charitable Contributions — U.S. Department of the Treasury Notice of proposed rule making: For-Profit Charitable Contributions — U.S. Department of the Treasury Notice of Proposed Rule making: For-Profit Noncharitable Contributions — U.S.

Online methods help you to to organize your doc management and enhance the productiveness of one's workflow. Observe the quick guide to be able to finished 21-526pdf - VeteranAidorg, steer clear of errors and furnish it inside of a well timed method:

How to accomplish a 21-526pdf - VeteranAidorg on line:

- On the website together with the sort, click on Start off Now and move for the editor.

- Use the clues to fill out the suitable fields.

- Include your individual information and speak to details.

- Make certainly that you simply enter proper information and numbers in suitable fields.

- Carefully look at the content within the variety as well as grammar and spelling.

- Refer to support section for those who have any queries or address our Assistance group.

- Put an electronic signature on your 21-526pdf - VeteranAidorg with all the guide of Indicator Device.

- Once the shape is finished, push Executed.

- Distribute the prepared form via e mail or fax, print it out or help save in your machine.

PDF editor makes it possible for you to definitely make alterations to the 21-526pdf - VeteranAidorg from any online world connected unit, customise it in line with your requirements, sign it electronically and distribute in numerous strategies.